- Daily: Bảng giá HRC & CRC

- Thị Trường Thép TQ

- Bản tin VIP

- Monthly: Tổng hợp thép thế giới

- Daily:Tin thế giới

- Dailly: Bản tin dự báo hàng ngày

- Weekly:Dự báo xu hướng thép Thế giới

- Weekly:Dự báo xu hướng thép TQ

- Dailly:Giá Trung Quốc

- Weekly: Tổng hợp tin tức tuần

- Weekly:Bản tin thép xây dựng

- Dailly:Giá chào xuất nhập khẩu

- Daily:Giá thế giới

- Dailly:Hàng cập cảng

- Weekly:Thị trường thép Việt Nam

- Daily:Điểm tin trong ngày

- Monthly:Tổng hợp thị trường thép TQ

- Tin Tức

- Kinh Doanh

- Kinh tế

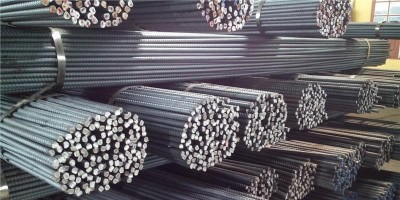

- Chuyên ngành thép

- Danh bạ DN

-400x200.jpg)